Tax extension 2022

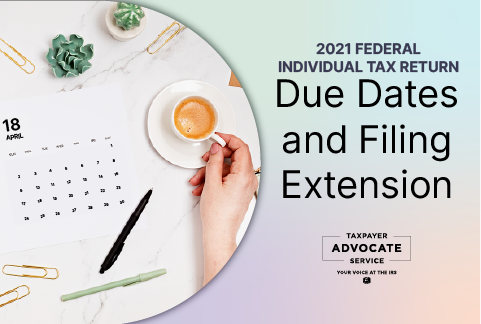

Extension requests must be filed no later that the regular due date of your return the IRS states on its website. For most taxpayers in the United States the deadline to submit a 2021 federal income tax return to the Internal Revenue Service IRS is Monday 18 April 2022.

Will The Irs Extend The Tax Deadline In 2022 As Com

The extension will only change your deadline for filing the tax return.

. If that still doesnt give you enough time to file taxes in 2022 theres one more date to keep in mind. So the extended tax deadline is October 15 unless a weekend gets in the way which it does in 2022. And it will give you until October 17 2022 to send your tax return to the IRS.

The IRS estimates that 152 million taxpayers will file for an extension which is Form 4868 in 2022. Americans are already falling behind in the current tax season according to the latest IRS statistics. Although there are several ways you can file an extension other than filing Form 4868 its still an easy option that wont take much of your time.

Filing this form gives you until October 15 to file a return. Consider filing for extension if in a rush As of April 8 the IRS had received more than 103 million returns for this tax season. How does a tax extension work.

Filing for an extension will give most taxpayers until October 17th to file their returns. April 18 tax filing deadline for most The filing deadline to submit 2021 tax returns or an extension to file and pay tax owed is Monday April 18 2022 for most taxpayers. However getting an extension does not give you more time to pay it only gives you more time to.

The form must be submitted on or before the normal tax due date. But what it doesnt do is give you an extension on your payment. Taxpayers in combat zones or disaster areas automatically qualify for a tax payment deadline extension.

A tax extension will have you six additional months to file your federal income tax return. You can usually escape the penalty by using Form 4868 to request an automatic extension to file your return. Citizens and resident aliens living outside the US.

Individuals can request an extension online by filling out Form 4868 using the IRSs Free File tool. A tax extension gives you until October 17 2022 to file your tax return. Nearly 116 million taxpayers filed Form 4868 in 2020 based on the most recent data.

E-file Your Extension Form for Free Individual tax filers regardless of income can use Free File to electronically request an automatic tax-filing extension. If you plan on requesting an extension youll need to request. Taxpayers who file for an extension on.

An automatic six-month extension Taxpayers can also request an extension to file their returns by April 18 or April 19 depending on your location. For 2022 the deadline is April 18th. IRS tax deadline 2022.

What you need to know. You need to submit the form by April 18 or print the form and mail it. Thats when taxes are.

If you owe money to the IRS those taxes are still due on April 18th. Tax Day 2022. Tax Day laggards.

Tax-filers in Maine and Massachusetts however will be able to submit their taxes until April 19 because of Patriots Day on April 18. Tax extension forms for 2021 are due by April 18 2022 and April 19 2022 for Maine and Massachusetts residents. Have until June 15 2022 to file their 2021 tax returns and pay any tax due the agency said.

Form 4868 Fillable PDF Like the other IRS forms you can file Form 4868 2022 using TaxUni PDF filler. Most years its April 15 for personal returns. In other words the request to file an extension and the 2022 tax deadline is on.

By law Washington DC holidays impact tax deadlines for everyone in the same way federal holidays do. If October 15 falls on a Saturday Sunday or legal holiday the due date is delayed until the next business day. Extension requests must be filed no later that the regular due.

Extensions stimulus credits and other last-minute questions answered CoDesign The most expensive 20th-century artwork ever auctioned is. Yes but only as long as you request to file to file an extension by tax deadline day. WASHINGTON -- Monday is Tax Day - the federal deadline for individual tax filing and payments - and the IRS expects to receive.

To make a long story short if you. April 18 2022 1049 AM MoneyWatch Over the past two years the IRS extended the tax filing deadline because of the COVID-19 pandemic giving Americans extra breathing room to wrap up their. Other deadlines including 15B in.

Taxes Due Tomorrow File Your Tax Return Or Tax Extension Now Cnet

Irs Announces 2022 Tax Filing Start Date

Will The Irs Extend The Tax Deadline In 2022 As Com

Child Tax Credit 2022 Schedule Family Stimulus Checks Worth 350 A Month Could Be On The Way See If You D Get Cash

:max_bytes(150000):strip_icc()/4868now-8776a44cf0674cc0815685077ec42bf7.jpg)

Form 4868 Application For Extension Definition

K11qjb0nmphdxm

Child Tax Credit 2022 Will Ctc Payments Finally Be Extended Marca

Income Tax Audit Due Date Extension Income Tax Return Filing Deadline Extended To March 15 Business News

Tax Refund Deadline 2022 What Should You Know Before April 18 Marca

Can T Finish Your Tax Return Today Learn How To File A Tax Extension Cnet

Tax Filing Season 2022 What To Do Before January 24 Marca

Tax Deadline 2022 When Is The Last Day To File Taxes 2022 Turbotax Canada Tips

Taxes Due Tomorrow File Your Tax Return Or Tax Extension Now Cnet

How To File An Extension For Taxes Form 4868 H R Block

Tas Tax Tip 2021 Federal Individual Tax Return Due Dates Extensions

2022 Transfer Tax Update

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money